Stop Strategy Hopping

- Tam Williams

- Aug 12, 2019

- 2 min read

Updated: Dec 19, 2020

Are you a Strategy Hopper

The bane of most new and unsuccessful traders is strategy hoping. Believe it or not, I used to be one of them. I think before I found my mojo, I tried all sorts of strategies. Moving average crossover, Elliot Wave, RSI, CCI, you name it I have probably tried it. For my part I strategy hopped, because I was looking for something that resonated with my being. I am sure that all these strategies are valid and they work. It's just that they did not work for me. So you will never hear me say a strategy doesn't work, because I believe they all work as long as you know how to use them. What I will say is that they did not work for me.

I am the sort of person that has a need to know how things works. I can't take things at face-value. I cannot cram information: I have to know for anything to work for me.

I remember trying to explain to a friend that I really needed to know what was actually happening at each price point. This was before I had discovered futures and was trading forex. That's when I realised that in futures, I can actually see inside a candle and see how much order and when orders are being executed, I felt like I have found my holy grail. Since discovering volume profile and footprint oderflow, I have not looked back and my trading improved in leaps and bounds. I do look at the DOM, (and execute on the DOM), however I find this a bit too fast for me at times. I am most comfortable looking at footprint orderflow.

For me, I can now literally read the story as easy as reading a text.

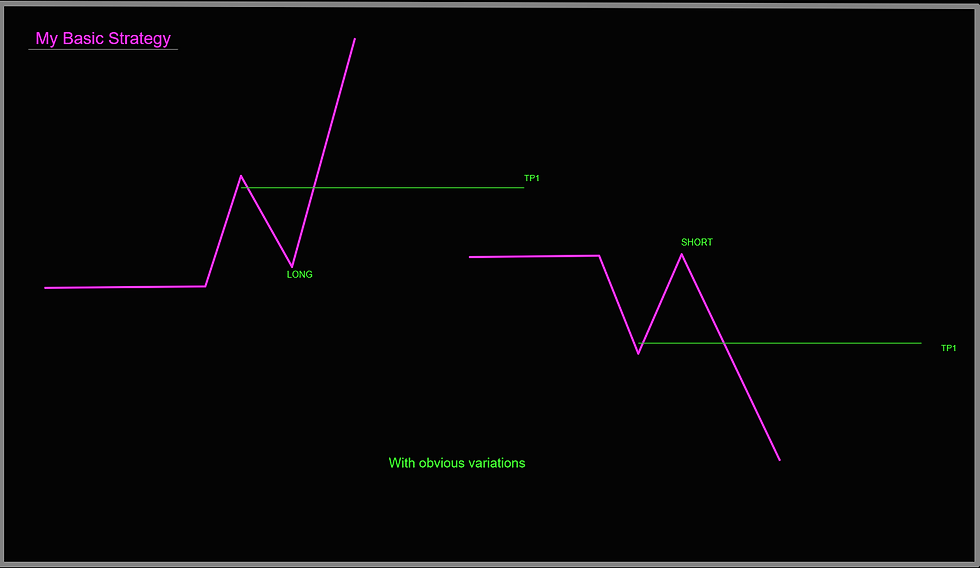

My footprint analysis is pretty basic. My trading plan and strategy rests on this simple pattern:

LONG SETUP

SHORT SETUP

Try watching price action without trading for a week and see what happens. This simple setup repeats every single day and on lower time frames it happens numerous times during the day. Try it and see.

Comments